how are property taxes calculated in martin county florida

Florida Counties With the LOWEST Median Property Taxes. Real Property records can be found using the Parcel ID Account Number Subdivision Address or Owner Last Name.

Palm Beach County Property Taxes

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

. Pay for confidential accounts. Enter 555 Main when trying to locate the property at 555 SE Main Street Stuart FL. Ad-Valorem Taxes are paid in the arrears.

The Childrens Services Council at a rate of 3618 the Florida Inland Navigation District at a rate of 0320 and finally the South Florida Water Management District at a rate of 2936. To a 3 per year increase. For information on Non-Ad Valorem taxes please call the Martin County Tax Collectors office at 772-288-5600.

One mill equals 100 per 100000 of property value. Trash drainage taxes or special assessments. A tax certificate when purchased becomes an enforceable first lien against the real estate.

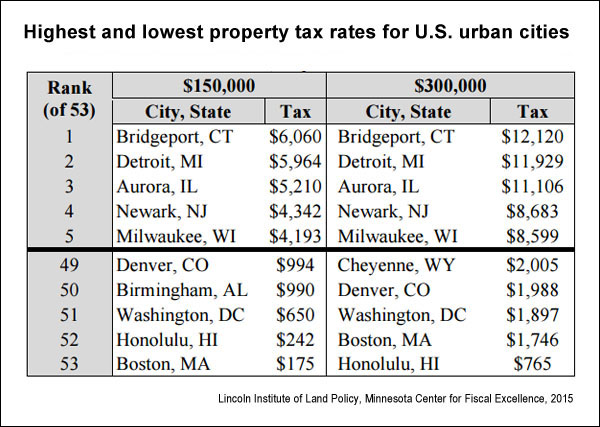

The rates are expressed as millages ie the actual rates multiplied by 1000. The sale allows citizens to buy certificates by paying the owed tax debt. This estimator is based on median property tax values in all of Floridas counties which can vary widely.

When searching by address enter street number and street name only. The median property tax also known as real estate tax in Martin County is based on a median home value of and a median effective property tax rate of 091 of property value. Were here to help you.

Property taxes in Florida are implemented in millage rates. This calculator can only provide you with a rough estimate of your tax liabilities based on the property. The median property tax on a 18240000 house is 176928 in Florida.

You must provide the police report number when filling out the application form HSMV 83146 for a replacement plate. Base tax is calculated by multiplying the propertys assessed value by the millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. The median property tax on a 25490000 house is 231959 in Martin County.

Discover valuable information on the property of your choice including the flood zone land usezoning building wind speed school zones utilities solid waste elected officials links to property appraiser site and other governmental areas with the option to print the information. Combined Tax and Assessment. The tax year runs from January 1st to December 31st.

The Martin County Tax Collector is responsible for. Please enter the information below for the current tax year to view and pay your bill. 3485 SE Willoughby Blvd.

Martin County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. It is understood that estimated Non-Ad Valorem taxes must be added to the estimated Ad Valorem taxes to obtain the full estimated property taxes of the proposed property ie. So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000.

Of the sixty-seven counties in Florida. Enter a name or address or account number etc. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

Based on 80- of Purchase Price. Property Tax Estimator Website help. Martin County Tax Collector.

3473 SE Willoughby Blvd Suite 101 Stuart FL 34994 772 288-5608. As you can see your real estate tax bill has many component parts encompassing several taxing districts. Ad-Valorem Taxes based on property value.

The market value of your home multiplied by the assessment ratio in your area equals the assessed value of your property for tax purposes. The median property tax on a 18240000 house is 191520 in the United States. Florida Department of Revenue.

Beginning on or before June 1st the law requires the Tax Collector to hold a Tax Certificate Sale. Loading Search Enter a name or address or account number etc. The Martin County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

If your license plate andor decal has been lost or stolen you must contact your local law enforcement agency to report the loss or theft. Having trouble finding what youre looking for in our website. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value.

This equates to 1 in taxes for every 1000 in home value. Based on a 1230 year-end. A number of different authorities including counties municipalities school boards and special districts can levy these taxes.

Here are the median property tax payments and average effective tax. The median property tax on a 25490000 house is 247253 in Florida. View 2021 Millage Rates.

There are other agencies that also tax property. Ad Find Out the Market Value of Any Property and Past Sale Prices. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

The Martin County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Martin County. Martin County calculates the property tax due based on the fair market value of the home or property in question as determined by the Martin County Property Tax Assessor. Martin County Property Appraiser.

For a more specific estimate find the calculator for your county. The median property tax on a 25490000 house is 267645 in the United States. Florida real property tax rates are implemented in millage rates which is 110 of a percent.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other taxing authorities set the millage rates. Having trouble finding what youre looking for in our website. Real Estate Taxes consist of two parts.

Homestead Properties are limited.

Miami Dade County Fl Property Tax Search And Records Propertyshark

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Hav Title Insurance Title Things To Know

/https://static.texastribune.org/media/files/b906b80467cec17d09ef438a570ef45c/day2-prop-tax-art.png)

How Are Texas Property Taxes Calculated And How Much Of The Money Goes To Schools Guide For The 2019 Legislative Session The Texas Tribune

Who Pays The Highest Property Taxes In Alabama Al Com

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Are Texas Property Taxes Calculated And How Much Of The Money Goes To Schools Guide For The 2019 Legislative Session The Texas Tribune

Palm Beach County Fl Property Tax Search And Records Propertyshark

Mississippi Property Tax Calculator Smartasset

Florida Dept Of Revenue Property Tax Data Portal

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

How To Find Tax Delinquent Properties In Your Area Rethority

What Are The Different Types Of Real Estate Property Taxes

Your Guide To Prorated Taxes In A Real Estate Transaction

Personal Property Tax Howard County

Florida Income Tax Calculator Smartasset

Real Property Tax Howard County